How to Deactivate Flipkart Pay Later

Online shopping has become increasingly convenient with services like Flipkart Pay Later. However, there are times when you might want to deactivate such services for various reasons. In this guide, we’ll walk you through the process of deactivating Flipkart Pay Later and explore some reasons why you might want to do so.

Table of Contents

What is Flipkart Pay Later?

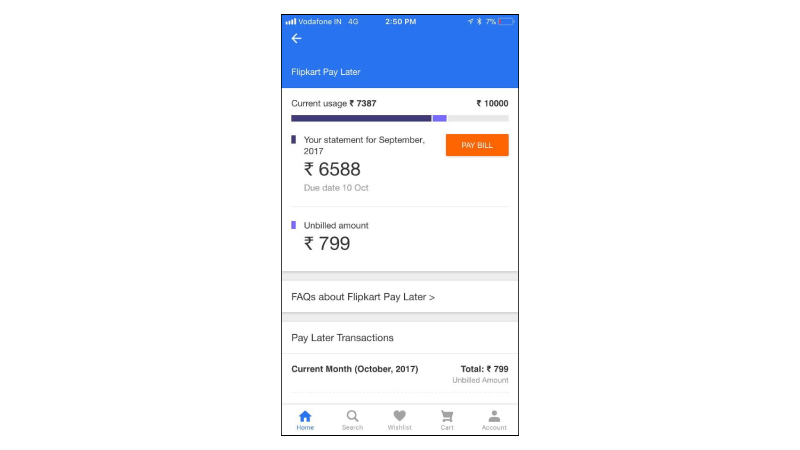

Flipkart Pay Later is a payment option offered by Flipkart, one of India’s largest e-commerce platforms. It allows users to make purchases on credit and pay for them at a later date. This service offers flexibility and convenience to shoppers, enabling them to buy now and pay later.

Reasons to Deactivate Flipkart Pay Later

Financial Control

While Flipkart Pay Later offers convenience, it can also lead to overspending if not managed carefully. Deactivating this service can help you regain control over your finances by limiting impulse purchases and encouraging more mindful spending habits.

Privacy Concerns

Some users may have privacy concerns associated with using credit-based payment services like Flipkart Pay Later. Deactivating it can help protect your personal information and financial data from potential security risks.

How to Deactivate Flipkart Pay Later

If you’ve decided to deactivate Flipkart Pay Later, the process is straightforward. Follow these steps:

- Login to Flipkart Account: Visit the Flipkart website or open the Flipkart app on your mobile device and log in to your account.

- Navigate to Payment Settings: Once logged in, go to your account settings and select “Payment Methods” or “Payment Settings.”

- Deactivate Flipkart Pay Later: Look for the option to manage your payment methods and locate Flipkart Pay Later. Click on it and choose the option to deactivate or remove it from your account.

Alternatives to Flipkart Pay Later

If you’ve deactivated Flipkart Pay Later but still want flexible payment options, Flipkart offers several alternatives:

- Credit/Debit Cards: Use your credit or debit card to make purchases on Flipkart.

- UPI: Make payments directly from your bank account using Unified Payments Interface (UPI).

- EMI: Opt for Equated Monthly Installments (EMI) to spread the cost of your purchases over time.

Tips for Managing Online Payments

Whether you use Flipkart Pay Later or other payment methods, it’s essential to manage your online payments effectively. Here are some tips:

Budgeting

Set a monthly budget for your online shopping expenses and stick to it. Tracking your spending can help you avoid overspending and stay within your financial limits.

Monitoring Transactions

Regularly review your transaction history to ensure that all purchases are accurate and authorized. Report any suspicious activity to your bank or the e-commerce platform immediately.

Security Measures

Take steps to protect your personal and financial information online, such as using strong, unique passwords and enabling two-factor authentication where available.

Conclusion

While Flipkart Pay Later offers convenience and flexibility, there are valid reasons why you might want to deactivate it. Whether it’s for better financial control or privacy concerns, knowing how to manage your payment methods responsibly is essential for a safe and enjoyable online shopping experience.

FAQs

- Can I reactivate Flipkart Pay Later after deactivating it?

- Yes, you can reactivate Flipkart Pay Later at any time by following the same steps for deactivation and choosing to enable it instead.

- Is deactivating Flipkart Pay Later permanent?

- Deactivating Flipkart Pay Later removes it as a payment option from your account, but you can always choose to activate it again if needed.

- Are there any fees associated with Flipkart Pay Later?

- Flipkart Pay Later may have interest charges or fees for late payments, so it’s essential to read the terms and conditions carefully before using the service.

- Can I use Flipkart Pay Later for all purchases on Flipkart?

- Flipkart Pay Later is available for eligible purchases, but certain products or sellers may not accept this payment method.

- Are there any eligibility requirements for Flipkart Pay Later?

- Eligibility for Flipkart Pay Later is determined by Flipkart based on various factors, including your credit history and shopping behavior.

Also read our blogs News Utilizer